5 Best Credit Card Readers for iPhone

If you run a small business, manage a team of freelancers, or sell at events, having a reliable credit card readers for your iPhone can make all the difference. You want to take payments easily without worrying about complicated hardware, downtime, or hidden fees.

After evaluating ten of the top solutions on the market today, we narrowed our list down to the five best credit card readers for iPhone that cover all the bases:

This guide will walk you through the best iPhone credit card readers. You’ll get a breakdown of how these readers connect to your iPhone, what apps they work with, and what fees you can expect.

Finding the best card readers for iPhones required extensive research, analysis of product information, vendor websites, competitor reviews, and firsthand experience with the devices.

Each iPhone credit card reader is scored based on the following categories:

Pricing and contract – 20%

We assess each card reader’s cost-effectiveness, including upfront costs, transaction fees, monthly fees, and hidden charges. Readers with clear, competitive pricing and no long-term contracts score higher. We also evaluate scalability — whether the pricing accommodates both small businesses and larger enterprises.

Payment processing features – 20%

Reliability and speed of payment processing are key to our evaluation. We review the types of payments each reader accepts — chip, contactless, and magstripe — and the efficiency of processing transactions. We rate readers that support a wide range of payment methods, including Apple Pay and Google Pay, more favorably.

Hardware features – 20%

Card readers with thoughtful design, portability, and durability are crucial for businesses on the go. We evaluate the hardware’s ease of use, battery life, and connectivity options (e.g., Bluetooth, Lightning port). Devices that are easy to set up and use and offer features like long battery life score higher in this category.

Security and scalability – 20%

Security is a top priority. We review the encryption methods used to protect transaction data, including support for EMV chip cards and compliance with industry standards like PCI-DSS. Scalability is also assessed, especially for readers that can grow with a business and offer integration with larger POS systems or other business tools.

User reviews – 20%

Finally, we analyze feedback from real-world users on platforms. These reviews give us insight into the customer experience, highlighting strengths and potential drawbacks. We focus on ratings related to ease of use, customer support, and overall satisfaction, ensuring that each reader performs well under everyday business conditions.

Best credit card reader for iPhone compared

Company

Our Score (out of 5)

Card Reader

Key Features

Square: Best overall credit card reader for iPhone

Overall Score

4.53/5

Pricing & contract

4.25/5

Payment processing

4.5/5

Hardware features

4.5/5

Security & stability

4.25/5

User reviews

5/5

Pros

- Clear pricing model with no monthly fees

- Supports all major payment types

- Longer battery life than previous generations

- Works seamlessly with Square POS app

- Accepts offline payments

- Positive user reviews

Cons

- Contactless and chip reader doesn’t support swiped magstripe payments

- 1.75% fee for immediate transfers

- Not compatible with all business types

Why I chose Square

If you want an iPhone credit card reader that is affordable, has great features, and is hassle-free, Square is the best choice. It’s ideal for businesses that need more than basic payment processing but don’t want to deal with complicated setups or high fees.

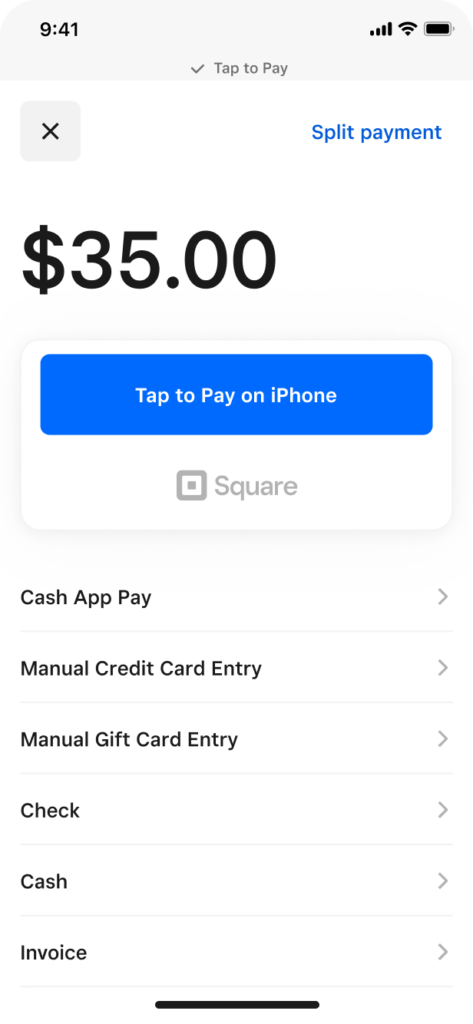

Setting it up with your iPhone is simple — just connect the reader via Bluetooth, and you’re ready to accept chip cards, contactless payments like Apple Pay, and even old-school swiped cards with Square’s free magstripe reader.

You only pay 2.6% + $0.10 per transaction for swiped, dipped, or tapped payments, which is competitive and keeps things simple.

If you’re comparing Square to SumUp, which is later on this list, Square wins in terms of overall features and ease of use. While SumUp charges 2.6% per transaction with a $54 card reader, it doesn’t offer the same range of business tools that Square’s app does, like in-depth sales reporting or seamless integration with other business software. Plus, with Square, you get your first magstripe reader free, and their contactless and chip reader is just $59. SumUp may look more affordable at first glance, but Square’s broader functionality makes it more versatile, which speaks to its scalability.

Another advantage is that your money gets deposited into your bank account the next day, or you can use instant transfers (for a 1.75% fee) if you need the cash right away.

Finally, with APIs and a huge range of integrations, it connects easily to other business software like accounting tools or eCommerce platforms, giving you more control over your operations.

Free tier (magstripe reader)

Price: Free

Features:

- This tier includes a simple magstripe reader that plugs into the headphone jack or Lightning port of your iPhone.

- It supports Visa, Mastercard, American Express, and Discover.

- Transaction fees: 2.6% + $0.10 per swipe.

- No Monthly fees: There are no recurring monthly fees, making it great for businesses just getting started.

Contactless & chip reader

Price: $49.99

Features:

- Allows for contactless payments via Apple Pay, Google Pay, and NFC-enabled cards.

- Supports EMV chip cards and has Bluetooth connectivity for a wireless experience.

- Transaction fees: 2.6% + $0.10 per transaction.

- No monthly fees: Like the free tier, there are no monthly charges after purchasing the reader.

Payouts

- Free 1-2 day payouts

- Instant or scheduled same-day payouts for a 1.75% fee

Here are the specs for Square’s Contactless & Chip reader:

Accepted payment types: EMV chip cards, contactless cards, and digital wallets like Apple Pay and Google Pay.

Transaction speed: Depends on the network connection; contactless transactions are quickest

Connectivity: Bluetooth Low Energy (LE). Supports USB-C connections for Android

Battery life: Not specified. Automatically enters “Sleep Mode” after 2 hours of non-use to conserve battery.

Charging time: 2 hours approx.

Charging option: Micro USB or USB-C port

Also read: Best Cloud POS Systems

Stripe M2: Best for online businesses

Overall Score

4.35/5

Pricing & contract

3.8/5

Payment processing

4/5

Hardware features

4.8/5

Security & stability

4.5/5

User reviews

5/5

Pros

- Top-tier security

- End-to-end encryption (E2EE)

- Accepts EMV chip cards, contactless payments and traditional magstripe cards

- Highly portable, weighing just 85 grams and measuring under 3 inches in width

- Developer-friendly API

Cons

- Only allows tipping through digital receipts

- High fees for international transactions

- No free POS hardware

Why I chose Stripe M2

With effortless integration with your e-commerce operations, a smooth connection to your iPhone via Bluetooth, and the ability to accept EMV chip, contactless, and magstripe payments — all in one compact, lightweight device — Stripe M2 iPhone credit card readers can hang with the best of them. The setup is simple, and if you’re already using Stripe to handle online transactions, the Stripe M2 fits perfectly into your existing payment flow.

The real advantage Stripe M2 has over competitors like Square lies in its deep integration with online payments. Stripe M2 allows you to consolidate both your in-person and online transactions into one system. Its unified API means all your payment data is synced, allowing you to track everything from customer analytics to revenue. This type of integration is something Square, while strong for in-person payments, doesn’t quite match.

When it comes to pricing, Stripe M2’s reader costs $59, similar to Square’s Contactless and Chip reader.

Stripe charges 2.7% + $0.05 for in-person transactions, which is slightly higher than Square’s 2.6% + $0.10. However, if your business primarily operates online, Stripe’s 2.9% + $0.30 per online transaction fee remains competitive across the board and allows you to scale your online business easily.

Another benefit is Stripe’s payout flexibility. You can receive your funds in as little as two days, with an Instant Payout option for a 1% fee, ensuring quick access to cash flow when needed. Square offers a similar Instant Deposit feature but at a 1.75% fee, making Stripe the more affordable option for immediate payouts.

For businesses focused on online sales, the Stripe M2 offers a unique advantage: it consolidates your payment processing tools under one umbrella, helping you stay organized without juggling multiple platforms. Square’s POS system offers great tools for retail businesses, but Stripe’s ability to handle complex e-commerce integrations with minimal fuss makes it ideal for companies that live in the online world.

Also read: Top Stripe Alternatives

Hardware costs

- Stripe M2 card reader: $59

This compact, Bluetooth-enabled reader accepts EMV chip cards, contactless payments (Apple Pay, Google Pay), and magstripe payments.

Payment processing fees

- Card-present transactions: 2.7% + $0.05 per transaction

Payout Times

- Standard payout: 2–7 business days

- Instant payouts: Available for a 1% fee (minimum $0.50 per transaction).

Here are the specs for the Stripe M2:

Accepted payment types: accepts EMV chip cards, contactless payments (Apple Pay, Google Pay), and magstripe payments.

Transaction speed: Exact speed details aren’t listed; however, Stripe M2 supports a high volume of transactions per charge, which points to efficient processing times.

Connectivity: It connects to your iPhone via Bluetooth

Battery life: The battery supports up to 800 NFC transactions or 1200 contact transactions, up to 42 hours of standby time and 28 hours of active use on a full charge.

Charging time: About two hours, it’s recommended to charge overnight for heavy use.

Charging option: Charges via a USB connection

SumUp: Best PIN-enabled readers

Overall Score

4.33/5

Pricing & contract

4.25/5

Payment processing

4.75/5

Hardware features

4.63/5

Security & stability

3.5/5

User reviews

4.33/5

Pros

- Send payment links via text or messaging apps

- Easy to set up, takes just a few minutes

- Free basic inventory tools synced across channels

- Competitive flat-rate fees

Cons

- Longer payout times

- Doesn’t offer comprehensive employee management features

Why I chose SumUp

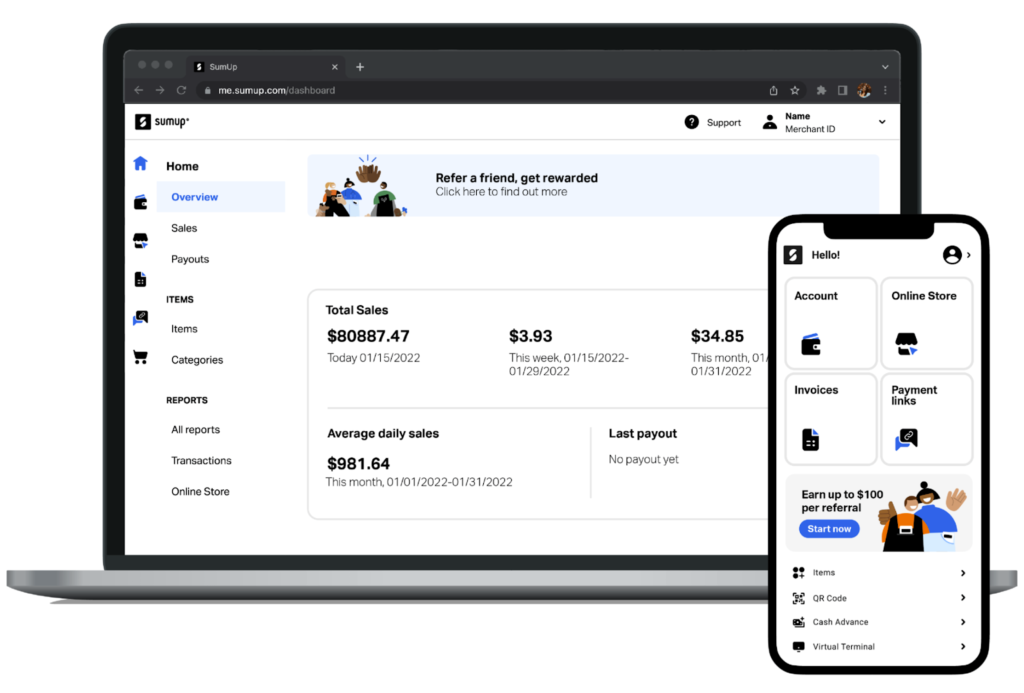

SumUp caters to businesses of all sizes by offering a diverse selection of card readers, allowing business owners to pick the device that best fits their specific needs. The options include the SumUp Plus, a sleek Bluetooth-enabled reader, and the SumUp 3G, which operates independently of any phone connection, offering unmatched portability.

SumUp’s pricing model is simple and transparent. You pay 2.6% + $0.10 per transaction for card-present payments, putting it in line with Square’s transaction fees. However, SumUp doesn’t charge any monthly fees, keeping operational costs low for small businesses and sole traders. While Square offers a larger ecosystem with its POS features, SumUp stands out for offering PIN-enabled mobile readers.

SumUp’s app, though more basic than Square’s, still provides essential features for tracking sales and managing inventory. However, Square’s app is more advanced, offering integration with third-party tools and more detailed reporting features, which makes it better for businesses looking for in-depth analytics. Where SumUp excels is in keeping things simple — its app is focused on ease of use and quick transactions.

It also offers hardware options that adapt to your business needs at lower processing fees, making it a very valuable iPhone credit card reader for businesses looking to save on costs without sacrificing mobility.

Also read: Best Free POS Systems

SumUp card reader ($39)

- Accepts chip cards and contactless payments.

- Includes a free mobile app for easy payment tracking and reporting.

- Simple setup process via Bluetooth connection to your iPhone.

- No monthly fees, making it ideal for seasonal or part-time businesses.

SumUp pro card reader ($99)

- Offers all the features of the basic reader but adds support for magstripe transactions.

- Includes a larger battery for extended use — approximately 100 hours of standby time.

- The device is designed for higher transaction volumes.

Transaction fees

Regardless of the chosen reader, SumUp charges 2.6% per transaction, which applies to all card types.

Here are the specs for SumUp’s entry-level card reader, SumUp Plus:

Accepted payment types: Magstripe, EMV chip, and contactless payments like Apple Pay and Google Pay

Transaction speed: Rapid transaction speed

Connectivity: Connects via Bluetooth

Battery life: Over 500 transactions on a single charge

Charging time: Approximately 2 hours

Charging option: Charges via micro USB

Also read: Lightspeed vs. Shopify: Best POS Systems

Shopify: Best for multichannel selling

Overall Score

4.29/5

Pricing & contract

3.94/5

Payment processing

4/5

Hardware features

4.5/5

Security & stability

5/5

User reviews

4.33/5

Pros

- Day-long battery life

- Sync in-person payments with your existing Shopify online store

- Supports multiple currencies

Cons

- Exclusive to the Shopify POS & ecommerce ecosystem

- No free plan

- Limited offline features

Why I chose Shopify

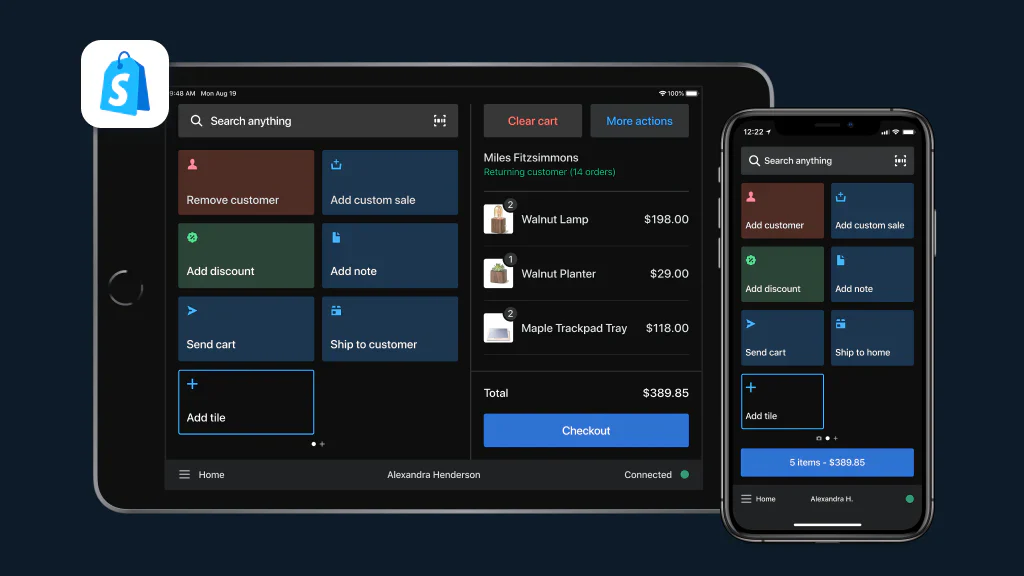

The core reason Shopify outshines competitors like Square in e-commerce integration is its deep synchronization between the Shopify card reader and its online store. Whether you make sales in-person or online, Shopify automatically updates your inventory, customer data, and orders in real time across all platforms. This integration makes it the ideal choice for retailers with both a physical and an online presence, allowing you to manage all transactions from a single system without needing third-party apps.

Square, while a highly versatile and user-friendly option, its online store offerings are relatively basic compared to Shopify’s sophisticated e-commerce tools.

When compared to Square’s hardware, Shopify’s Tap & Chip Reader is similarly priced at $49 for the reader, though Shopify offers a charging dock for an additional $39, which can add convenience for businesses running multiple transactions in a day. Shopify’s hardware also integrates directly into its broader POS and e-commerce ecosystem. Square offers this functionality too, but many users find the Shopify integration experience to be more user-friendly.

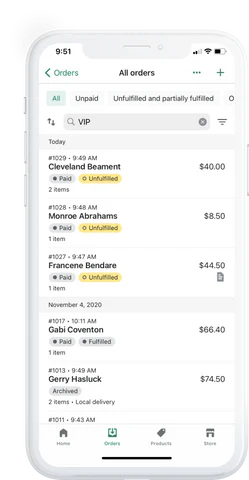

The Shopify app is designed to work hand-in-hand with the Shopify card reader and is iPhone-compatible, ensuring that all data is instantly available at your fingertips. The app also makes it easy to customize taxes, add discounts, and manage loyalty programs directly from your iPhone.

Shopify’s card reader is ideal for retailers who need to seamlessly manage both their online and in-person sales.

Basic Shopify Plan ($39/month)

Processing Fees for In-Person Payments: 2.6% + 10 cents per transaction.

Key Features:

- Access to Shopify POS Lite (included at no extra cost).

- Full integration with Shopify’s online store and inventory management.

- Automatic updates between online and in-store inventory.

- Discount codes and customer profiles.

- Basic reporting and analytics.

- 24/7 customer support.

Shopify Plan ($105/month)

Processing Fees for In-Person payments: 2.5% + 10 cents per transaction.

Key Features:

- All Basic Shopify features, plus:

- Advanced reporting and analytics, including retail-focused insights.

- Professional marketing tools such as advanced discount options.

- Integration with more sales channels (e.g., Facebook, Instagram, etc.).

- Enhanced shipping discounts.

Advanced Shopify Plan ($399/month)

Processing fees for in-person payments: 2.4% + 10 cents per transaction.

Key features:

- All features from the Shopify Plan, plus:

- More detailed reporting, including custom reports.

- Lower transaction fees for in-person and online sales.

- Advanced shipping settings and real-time carrier shipping.

- Support for third-party calculated shipping rates.

- Priority customer support.

Card Reader Hardware Costs:

- Shopify Tap & Chip Reader: $49

- Optional Dock: $40

Here are the specs for the Shopify Tap & Chip reader:

Accepted payment types: Shopify card readers support all major credit cards, including Visa, Mastercard, American Express, and Discover, plus mobile wallets like Apple Pay and Google Pay.

Transaction speed: Transactions process quickly within a few seconds, depending on the type of connection. (Bluetooth).

Connectivity: Connects via Bluetooth, There are also versions that connect through the audio jack or lightning port.

Battery life: Up to 400 transactions on a full charge.

Charging time: Around 1-2 hours.

Charging option: Charges via a USB cable and is compatible with a charging dock for stationary use.

Also read: Square vs. Shopify: Which is Best for Your Business

CloverGo: Best user reviews

Overall Score

4.16/5

Pricing & contract

3.44/5

Payment processing

3.44/5

Hardware features

3.88/5

Security & stability

4/5

User reviews

5/5

Pros

- Offline payment processing

- Choice of merchant account on Fiserv network

- Next-day payouts

- Positive user reviews

Cons

- Compatibility with third-party hardware (like printers) is limited.

- Although Clover Go can process payments offline, there is a higher risk of transaction failure when syncing once the connection is restored.

Why I chose CloverGo

Clover Go is engineered specifically for mobile use, offering Bluetooth connectivity that pairs effortlessly with iPhones. Its portable design, combined with a powerful rechargeable battery, ensures that users can accept payments on the go without worrying about battery life.

Clover Go is widely available through major retailers and merchant account providers operating on the Fiserv network, making it a popular and widely-used solution. Though Square can also be purchased through retailers, Clover is the only option on this list that can work with many different processors.

In contrast, Square Reader, Clover Go’s closest competitor, offers similar functionality but lacks some of Clover’s advanced security features, such as end-to-end encryption. And, of course, Square’s hardware can only be used with Square’s payment processing.

Overall, the app itself is extremely highly rated, with a current 4.8 out of 5 rating on the Apple App Store. Only Square rivals Clover’s positive user reviews.

Clover Go Basic Plan

Cost: $49 for the card reader

Transaction Fees: 2.6% + $0.10 per transaction for swiped, dipped, or tapped payments

Features:

- Bluetooth connectivity with iPhone

- Accepts all major credit cards, including Visa, MasterCard, Discover, and American Express

- Supports EMV chip, magnetic stripe, and contactless payments (like Apple Pay)

- Real-time transaction monitoring via the Clover Go app

- Next-day payouts at no extra cost

- No long-term contracts or cancellation fees

- Basic reporting tools to track sales and transaction history

Clover Go Register Lite Plan

Cost: $9.95 per month

Transaction Fees: 2.7% + $0.10 per transaction

Features:

- Includes all features from the Basic Plan

- Enhanced inventory management features within the Clover Go app

- Access to customer tracking and basic loyalty programs

- Ability to track discounts and offer promotions

Here are Clover Go’s specs:

Accepted payment types: Clover Go supports chip (EMV), swipe, and contactless payments, including Apple Pay, Google Pay, and Samsung Pay. It also offers Tap-to-Pay functionality on iPhone devices

Transaction speed: Exact transaction speed details are not specified

Connectivity: Connects to iPhones via Bluetooth

Battery life: Battery supports around 160 dips, swipes, or 130 contactless transactions per charge

Charging time: Precise times aren’t available

Charging option: Uses micro-USB for charging, and an optional Go Dock can enable continuous charging while mounted for countertop use

Key features of iPhone credit card readers

When choosing the right credit card reader for your iPhone, you’ll want to focus on a few key features that can make your life easier and ensure smooth transactions. Here are some fundamental points to consider:

Payment types: Look for readers that accept a variety of payments, including chip cards (EMV), contactless payments like Apple Pay and Google Pay, and magstripe cards (though these are becoming less and less common).

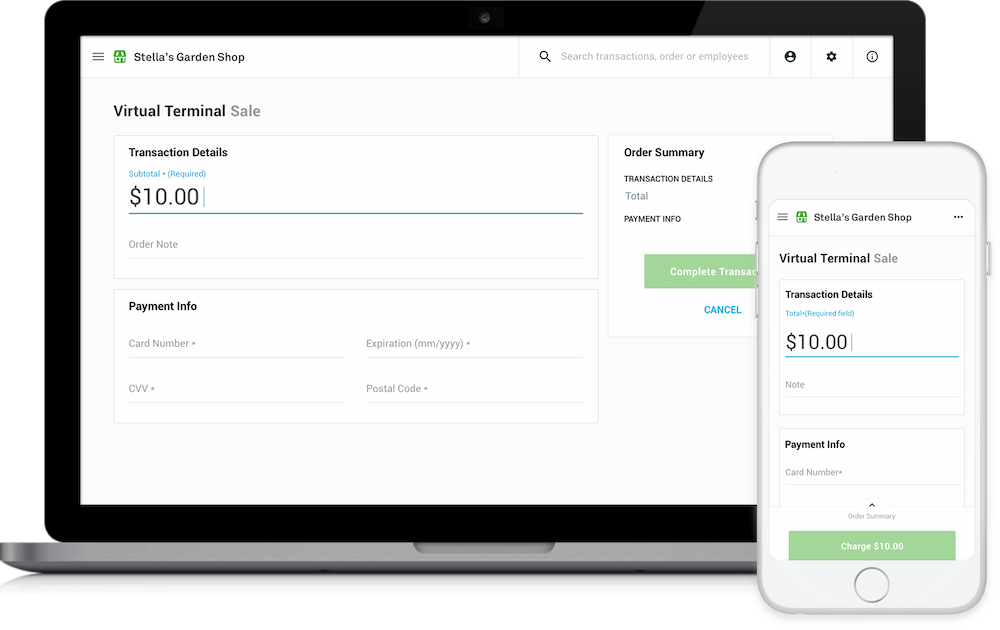

POS app: The app should handle transactions and offer business tools like inventory management, invoicing, and customer engagement features (e.g., Square POS, Shopify POS). Additionally, many corresponding POS apps have Tap to Pay, so you can accept contactless payments even without hardware. If you take orders over the phone, you may also want to check if the app allows you to manually key-in payments.

Connectivity: Most readers connect via Bluetooth for wireless use, though some budget options may require a plug-in format like a headphone jack or Lightning connector.

Battery life: Bluetooth-enabled readers generally last all day on a single charge, while plug-in readers don’t require charging. Either way, most card readers list how many transactions they can run on a single charge and how long it takes to charge the battery. Make sure the option you choose can handle your typical transaction volume, and/or has a portable charger that works with your setup.

Transaction fees and costs: Expect to pay a flat fee per transaction, around 2.6% + $0.10 for card-present payments, with most providers offering no monthly fees. However, it’s always a good idea to shop around for the lowest rates. And, of course, consider contract terms and whether the card reader comes with an annual contract, or if you’ll be able to use it as-needed with no obligations.

Choosing which solution is best for your business

Square is a go-to option for a versatile, all-in-one solution. Its easy-to-use hardware, competitive pricing, and POS app make it ideal for small businesses that need flexibility and scalability.

If your focus is on e-commerce, especially if you’re using Shopify, the Shopify reader is a seamless choice for managing both in-person and online sales in one system.

For businesses on a budget, SumUp offers an affordable option without sacrificing reliability. Meanwhile, Clover Go and Stripe M2 are excellent for those who need fast payouts or already use specific payment processors.

When choosing the right card reader for iPhone for your specific business needs, remember, your decision will depend on your payment volume, types of transactions, and integration needs. By evaluating these factors, you’ll find the solution for you and your team.

FAQs

The best credit card reader for iPhone is Square, thanks to its ease of use, affordable pricing, and robust POS app, making it a great all-around solution for small businesses. Other top choices include Shopify for multichannel sellers and SumUp for affordability.

Yes, you can accept credit cards with an iPhone by using a credit card reader like Square or Shopify, along with a payment app. These readers connect via Bluetooth or the Lightning port and allow you to process payments on the go.

Yes, you can use your iPhone as a card reader by downloading a mobile payment app and connecting a compatible credit card reader, such as Square or Clover Go. Some newer models also support contactless payments without additional hardware.

To set up a card reader on an iPhone, you simply download the payment provider’s app (like Square POS), pair the reader via Bluetooth or Lightning port, and follow the in-app instructions to start accepting payments.

The post 5 Best Credit Card Readers for iPhone appeared first on TechnologyAdvice.