Square vs Paypal: Which Should You Choose in 2024?

Key takeaways

Square is best for businesses that need an all-in-one POS solution. PayPal is best for businesses looking for a versatile online and mobile payment processor. When comparing Square and PayPal, look closely at each provider’s ability to scale along with your business requirements.

Square and PayPal are two popular names in payment processing. Both are great for quickly launching startups and accepting a wide variety of payment methods at a low cost. Not surprisingly, these similarities often result in a recurring Square vs PayPal debate over which is best for different business types.

Below we take a closer look at Square and PayPal, how they work, what sets them apart, and when to choose one over the other.

Square and PayPal are just two of the many POS software providers in the industry. Check out other POS systems options on our list.

For the best value all-in-one POS and payment system, choose Square

For an easy-to-use, versatile online and mobile payment solution, choose PayPal

Square: Best for small businesses needing an all-in-one POS solution

Overall Score

4.34/5

Pricing

4.25/5

Hardware

4.5/5

Payment software

4.17/5

Support and reliability

3.75/5

User experience

4.69/5

User scores

4.67/5

Pros

- Instant merchant account approval

- Free industry-specific POS software

- No monthly fee for payment processing

- Free basic website builder

- Waived chargeback fee of up to $250/month

Cons

- Payments exclusive to Square POS

- Flat-rate fees are not the cheapest

- Account stability issues

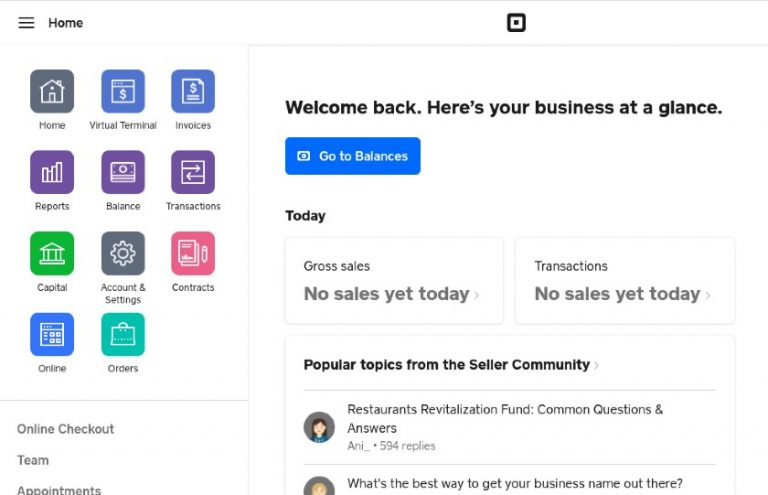

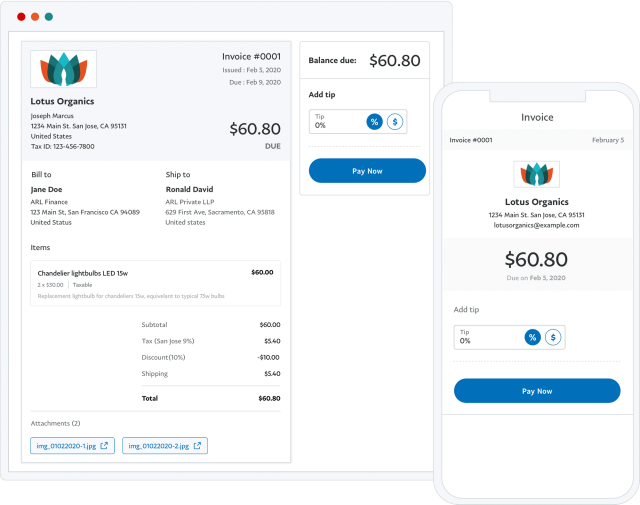

Square is an all-in-one POS solution popular among businesses for its affordability and ease of setup. The system includes a proprietary payment processing service built into the POS software with a variety of card and digital payment methods ready to use after signup. With its free basic software plan, Square users can set up a POS and start accepting payments within the day with little to no upfront cost. This makes Square the ideal payment processor for startups and businesses on a budget.

With Square’s ecosystem, users can easily scale their business with ready integrations and optional paid add-ons. This includes everything from online platforms and invoicing to employee management and marketing. Square also offers industry-specific free and paid POS software that users can upgrade at pace with their business needs. Square’s proprietary hardware is also among the most reliable and affordable on the market.

For enterprise-level businesses, Square recently launched its advanced POS system tools that support custom, developer-based integration and upgrades similar to Stripe’s. Custom rates for large-volume transactions are also available.

Fully integrated POS and payments solution

Square’s POS system comes with a built-in payment processor, Square Payments. There is no extra monthly cost for using the service, just the transaction processing fees.

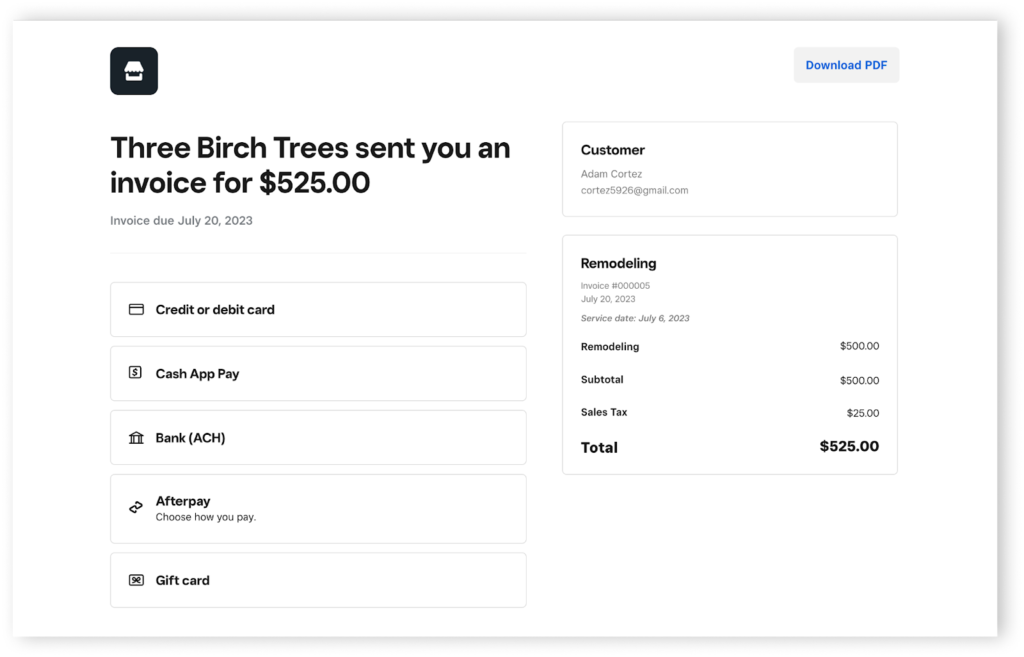

Payment methods

Square allows you to accept credit cards, ACH, and digital wallet payments. It supports multiple payment services, such as invoicing, recurring billing, and MOTO payments, with its virtual terminal. Square has its own buy now, pay later (BNPL) service (Square AfterPay) and a peer-to-peer payment service (Cash App) that can process cryptocurrency payments.

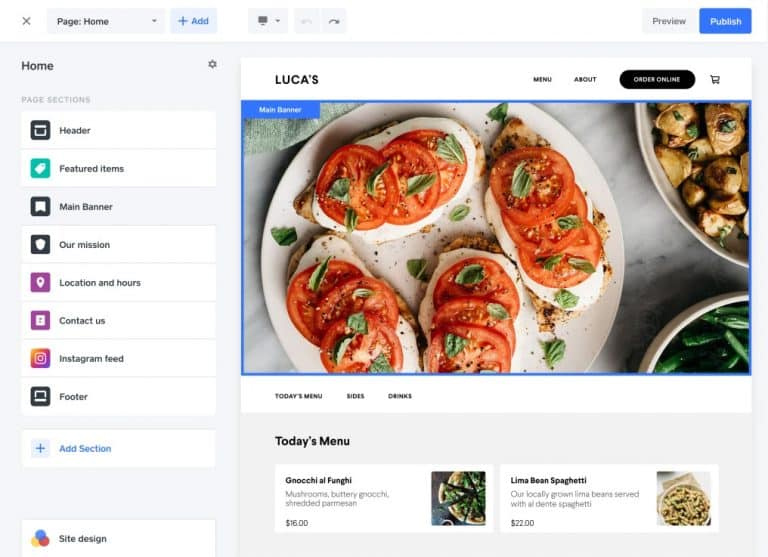

Native e-commerce platform

Square provides its own e-commerce platform with a free plan that allows users to create and personalize their business website. The website builder uses a drag-and-drop function that makes it easy to complete without any coding knowledge.

Omnichannel payments

Square Payments is fully integrated into the POS system, so sales and customer data are accessible online, on mobile, and in-store.

Proprietary hardware

Square offers a range of proprietary hardware. Its mobile card readers are divided into magstripe (for swipe payments) and contactless (for EMV chip and NFC payments). Square’s POS hardware includes iPad stands that can be set up either as a countertop or kiosk, a standalone POS terminal, and an all-in-one register. Businesses can purchase hardware in installments and the first magstripe reader comes free with every sign-up.

Read more: Top Square alternatives

PayPal: Best for businesses looking for versatile online and mobile payment services

Overall Score

4.21/5

Pricing

4.25/5

Hardware

4.25/5

Payment software

4.17/5

Support and reliability

3.33/5

User experience

4.69/5

User scores

4.60/5

Pros

- Compatible with most ecommerce platforms

- Fast merchant account approval

- Proprietary POS software

- Instant access to funds

- Trusted consumer brand

Cons

- Complex fee structure

- Poor customer support

- Account stability issues

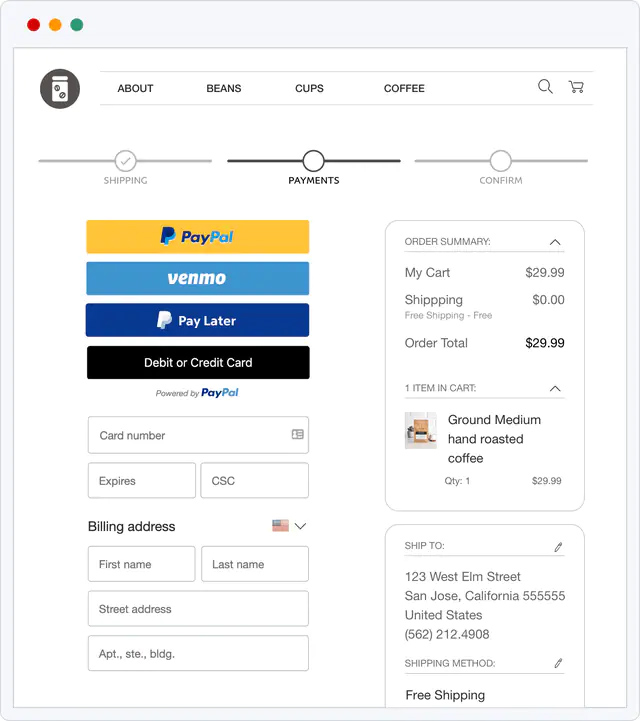

PayPal is a pioneer and a trusted name in the payments industry. Like Square, PayPal is easy to set up and lets users start accepting payments within the day. PayPal’s online checkout service can be easily added to any e-commerce platform, and having the PayPal brand is proven to boost conversions. At present, there are around 400 million active consumers with a PayPal account who readily use the service to make purchases on websites that offer a PayPal checkout. This means you get the same number of opportunities to make a sale with a PayPal payment option on your checkout.

Previously, upgrading to Braintree was the best option for setting custom upgrades to use PayPal for business. Today, PayPal offers an enterprise solution that provides users with advanced checkout solutions to integrate with other custom e-commerce websites and mobile POS systems. This includes features such as accelerated guest checkouts, global payment processing, dispute automation, and payment orchestration. Developer documentation is also available for those who prefer custom-built solutions.

Early this year, PayPal launched new features that harnessed artificial intelligence (AI) to improve customer checkout experience. This includes smart receipts, product recommendations, better Venmo integrations, and shoppable cashback offers.

Payment methods

PayPal allows users to accept credit card, digital wallet, and eCheck payments and supports invoicing, cross border, and virtual terminal transactions. Like Square, PayPal also has its own BNPL, Pay in 4, and peer-to-peer payment service, Venmo.

Checkout integrations

The PayPal Checkout is a customizable payment platform that users can add to their website as the main checkout service or as an additional payment method. PayPal Checkout can also be used without a website through a payment link that can be embedded on emails, digital invoices, and social media platforms.

Trusted consumer brand

PayPal is a trusted brand among online consumers and is well-known for boosting conversions on websites with a PayPal checkout.

Proprietary POS software

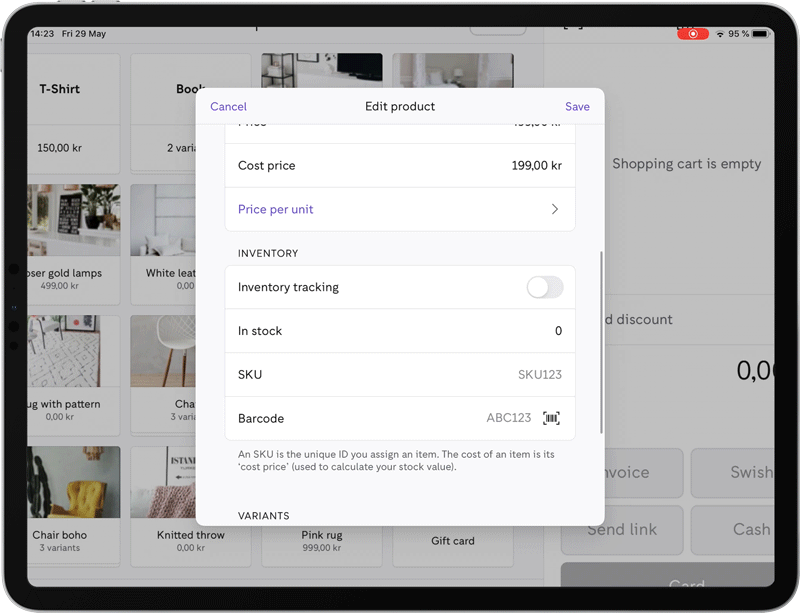

PayPal Zettle is PayPal’s free mobile POS software for in-person sales. The system can be used on a tablet and paired with the Zettle mobile card reader for an in-store setup or a smartphone for mobile sales.

Fast access to funds

One of PayPal’s unique features is its ability to provide businesses with fast access to cash. While both PayPal and Square can process same-day funding for a fee, PayPal merchants can already access their sales proceeds through their PayPal balance in PayPal’s digital wallet — PayPal’s pioneer service. Businesses can spend their PayPal balance to pay bills, pay employees, or purchase assets online.

How are Square and PayPal different?

Software type

POS with built-in payment processing

Online payment processing; optional simple POS

Fee structure

Flat rate

Flat rate

Contract type

Free/Pay-as-you-go

Free/Pay-as-you-go

Payment service integration

Exclusive to Square ecosystem

PayPal Zettle

Some POS systems

Most e-commerce platforms

For larger businesses

Custom pricing for industry-specific POS system

Advanced features in PayPal Enterprise

Square and PayPal are both small business favorites mainly for their ease of set up, free merchant account, and pay-as-you-go plan. That said, the two are popular for different reasons:

Software type

Square is the go-to provider for all-in-one POS with built-in payment services. PayPal, on the other hand, is well-known as an online and mobile payment services provider. PayPal also has a POS software, but the system is simpler and lacks the versatile features of Square’s POS. Meanwhile, Square also offers online checkout, but the use is limited within Square’s e-commerce platform.

PayPal’s mobile app doubles as a digital wallet and provides more functionality than Square’s; for example, it allows accepting and storing cryptocurrency and instant access to funds. The contrast between Square and PayPal’s primary software and use also makes the two providers cater slightly to two different types of small businesses. Square is more ideal for a brick-and-mortar setup while PayPal is the better choice for businesses that require mobility and wider online integrations.

Compatibility with sales platforms

Square is easy to set up because all the components are already integrated; even the hardware is configured and ready to use out of the box. The downside to this arrangement is that all the features only work with other Square products, so business growth is limited to Square’s capabilities. Square Payments, for example, is not available if you want to switch to Shopify’s e-commerce platform or Clover’s POS software.

Meanwhile, PayPal’s advantage is that its payment services are designed to work with most online e-commerce platforms and some POS systems. This way, users can choose and replace e-commerce and POS platforms based on their business needs without giving up their PayPal account.

Read more: Types of POS systems

Scalability

For large, enterprise-level businesses, Square focuses more on better in-house POS software capabilities combined with volume discounts for sales greater than $250,000/year. PayPal, on the other hand, offers support for wider payment processing functionalities such as global payments, payment optimization and orchestration, and network compliance.

Square vs PayPal: Pricing

Monthly account fee

$0–$89

POS software

$0–$30

Payment services

Includes POS

Full POS

Optional Mobile POS

In-person transaction fee

2.6% + $0.10

2.29% + $0.09

Online transaction fee

2.9% + $0.30

2.59% + $0.49 to 3.49% + $0.49

ACH/ eCheck:

1%, Min $1 (ACH)

3.49% + 49 cents, $300 cap (eCheck)

Discount for nonprofits

✓

✓

Same-day or instant funding

1.75%

For same-day or instant

1.5% Instant access to funds via PayPal Balance

Hardware

$0–$799

$29–$699

Chargeback fee

Waived up to $250/month

$20 (for guest checkouts)

Volume discounts

> $250,000 sales volume/year

N/A

When comparing PayPal vs Square fees, it’s important that we first make a clear distinction as to what is covered in their monthly account fees.

Square’s monthly account fee is for its POS system. The built-in payment services feature is free, so users only have to pay the transaction fees every month. Meanwhile, PayPal’s monthly account fee is for its payment services. The mobile POS app Zettle is free but optional, and there are no available upgrades.

This distinction, again, highlights the difference between PayPal vs Square target users. It also helps to better compare the two for cost-effectiveness.

PayPal clearly offers slightly cheaper rates. However, unlike Square, PayPal’s payment processing fees are complex and include additional monthly charges for features, such as $30/month for using its virtual terminal and $25/month when using PayPal checkout with a third-party payment processor.

Between the two, only Square users can upgrade to a paid industry-specific (retail, restaurant, and appointments) software plan. Only with Square can users get a volume discount, which, again, makes it the better choice for small businesses with steady sales.

Related reading: Best retail POS systems and best restaurant POS systems

Square vs PayPal: Payment services

Credit/Debit cards

✓

✓

Digital wallets

✓

✓

ACH/eCheck

ACH

eCheck

Payment gateway

✓

✓

Invoicing/Recurring billing

✓

✓

International

✗

✓

Virtual terminal

✓

+$

Microtransactions (<$10)

✗

✓

HIPAA compliance (healthcare)

✓

✗

BNPL

✓

✓

Peer-to-Peer

Cash App

PayPal app & Venmo

Cryptocurrency

In Cash App

✓

Square and PayPal are equally outstanding in terms of payment services, so the choice ultimately boils down to which provider matches a user’s business needs better.

When to choose Square

Choose Square if you determine that its POS system, e-commerce platform, and other business management tools meet your business needs. This ensures that you can maximize what Square has to offer and avoid compatibility issues. Because while Square supports independent payment links that can be added to invoices, social media, and instant messaging platforms, its online checkout only works with the Square ecommerce platform.

You should also choose Square if you need niche POS and payment services. For example, Square is compatible with healthcare services because it signs business associate agreements to ensure Health Insurance Portability and Accountability (HIPAA) compliance. Users planning to sell some form of CBD products can process sales via Square’s CBD program.

When to choose PayPal

Choose PayPal if you want more flexibility with integrations. PayPal offers a more flexible payment gateway than Square because PayPal’s online checkout service can be integrated with most e-commerce platforms and POS systems like Hike and Clover. Users who often process microtransactions, eChecks, cross-border, and cryptocurrency payments will do better with PayPal.

Does Square accept PayPal?

The quick answer is yes. Merchants using Square’s e-commerce platform can add PayPal payment methods without extra cost. PayPal charges its standard fees for Payflow Pro payment gateway, which includes a $25 monthly fee.

Note that this feature will no longer be available to Square merchants in Canada after October 29, 2024.

Read more: Best credit card processors

Square vs PayPal: Point of sale

POS Software

Proprietary POS

Proprietary POS

Integrates with some POS systems

Mobile POS

Free mobile POS app

Free mobile POS app

Ecommerce integration

Exclusive to Square ecommerce platform

Integrates with most websites

Hardware setup

Mobile and in-store

Primarily mobile

Square is clearly miles ahead of PayPal in both POS software and hardware. While both Square and PayPal offer a free POS software plan, Square can be upgraded to a paid plan that offers industry-specific features. It also comes with optional products such as payroll, marketing, and loyalty functionalities.

Read more: Toast vs Square

Square’s POS hardware is also significantly more extensive than that of PayPal, as it offers both mobile and in-store countertop setup. Each proprietary Square countertop hardware comes with a built-in credit card reader/payment terminal.

When to choose PayPal POS

Choose PayPal if your priority is simple in-person sales and significantly lower transaction rates. The PayPal POS system is mobile-based, which can be downloaded onto a smart device and paired with PayPal’s mobile credit card reader. The POS software itself supports simple inventory management along with employee and customer management, as well as reporting tools.

PayPal also offers better in-person rates and great discounts for the first mobile credit card reader, making it more ideal than Square for businesses looking for a simple mobile POS setup.

Read more: Best POS hardware

Square vs PayPal: Customer engagement

Omnichannel sales

✓

For enterprise-level business

Multichannel sales

✓

✓

Loyalty and Rewards

✓

Integration

✓

✓

Social Media

✓

✓

CRM feature

Great

Good

Building a customer base and keeping them engaged is a key factor for growing businesses. Square and PayPal’s customer engagement capabilities are different. Square has a more rounded set of features that allows users to connect with in-person and online customers, while PayPal excels in keeping online customers engaged.

Both Square and PayPal offer multiple platforms for selling and accepting payments—on a website, on social media, via instant messaging, online invoicing, and in-person via mobile or in-store. However, only Square offers a fully integrated omnichannel selling feature for small businesses, primarily because it has a more defined in-person POS functionalities to work with its e-commerce platform.

When to choose PayPal

Meanwhile, PayPal’s checkout services can be integrated with a couple of POS systems (Hike and Clover), but PayPal’s POS software, Zettle, does not integrate with online stores that use PayPal checkout. Omnichannel features are available for larger businesses through developer coding and integrations.

Square also offers native loyalty management and rewards programs, while PayPal requires third-party integrations. Either option will require users to pay extra, so users looking for the easiest setup may prefer Square, but those that have a preferred third-party loyalty and rewards platform may opt for PayPal’s integrations.

Read more: Lightspeed vs Shopify

Square vs PayPal: Risk management

Square and PayPal offer similar industry-standard risk management features. Both are Payment Card Industry (PCI) Level 1-compliant payment platforms equipped with machine-learning fraud protection tools and customizable filters.

When to choose Square

For businesses on a budget, choose Square. Square Risk Manager is free to use and provides users with an array of customizable fraud monitoring and prevention tools. This includes 3D secure that routes the customer data to the card issuer for identity confirmation and a block list that can be used to flag future payments from suspicious card information, emails, and IP addresses.

Square also provides a chargeback management platform where users can get notified and respond to customer chargeback claims from the merchant dashboard.

Read more: Best POS Inventory System

When to choose PayPal

Choose PayPal if your business needs a more scalable solution. PayPal offers two risk management options. The basic fraud protection is free and is designed to stop potentially fraudulent transactions based on a set of fraud filters such as purchase price and item ceiling, shipping and billing mismatch, AVS and CVV fails, and IP address velocity.

Advanced fraud protection that costs $10/month includes additional filters for international payments, USPS address validation, IP and email service provider validation, account number velocity, geolocation, and chargeback management platform.

Clearly, PayPal provides more custom fraud protection filters that are ideal for midsize to large businesses, particularly those that accept cross-border payments. However, these advanced tools, including chargeback management, cost an additional monthly fee.

Square vs PayPal: Ease of use

Both Square and PayPal are popular for their ease of use, earning an identical user experience score of 4.69/5 in our evaluation. Both offer easy sign-up (with no merchant account application process required), easy setup (where users can start accepting payments in minutes), and easy-to-use interfaces.

What makes Square stand out, however, is that most of the features needed to run a business are available within the Square ecosystem, and it offers hardware that can be readily used out of the box. Omnichannel sales are automatic for users intending to sell in-store, online, and on mobile.

On the other hand, PayPal readily integrates with most online platforms, and its mobile app can accept more alternative payment methods. This makes PayPal a far better option for users selling online and on mobile.

Read more: How to use a POS system

Which is best?

Square and PayPal are both exceptional business platforms that are similar in a lot of ways but also distinct in some features.

Square’s all-in-one platform makes it easy to launch any business, but the exclusivity of its features can limit the system’s ability to grow and keep up with business requirements as it grows.

PayPal’s versatile payment services platform gives users the flexibility to expand their business online; however, its POS software is basic and can be easily left behind by businesses with a growing demand for better POS functions.

Related reading: Stripe vs Square and Stripe vs PayPal

Making your choice

When choosing between PayPal vs Square, it’s important to first consider your type of business. If your goal is to create and expand online sales, with or without an e-commerce website, then PayPal will likely be the right choice. However, if you have a brick-and-mortar business that requires a quick and cost-effective POS setup, then Square is the better option.

Frequently Asked Questions (FAQs)

PayPal is clearly the better choice over Square for businesses that sell online. It provides a wide range of payment methods and more payment processing services for small businesses, plus expanded payment tools for larger organizations.

Both Square and PayPal are cost-effective payment and POS solutions for small businesses. They both offer free plans. However, PayPal requires additional monthly fees for certain payment tools, such as access to its virtual terminal and recurring billing features.

Both Square and PayPal are great options for small businesses. However, Square’s scalability can be limited by its POS features. PayPal, on the other hand, is the better choice for growing online businesses with its suite of expanded payment processing features.

By default, no. Unlike PayPal, Square’s mobile app does not include a digital wallet function. While anyone with a PayPal business account can make purchases directly from the PayPal balance (funded by the user’s sales proceeds), Square merchants will not have this function unless they sign up for a Square Business Bank account.

Yes, Square’s payment processing service is Level 1 PCI-compliant, which means that the system is equipped with industry-standard data protection and fraud detection management features.

The post Square vs Paypal: Which Should You Choose in 2024? appeared first on TechnologyAdvice.