Top 7 Vanta Alternatives to Consider in 2025

The Rise of Compliance-Centric Platforms

Vanta was developed to help organizations achieve SOC 2 compliance quickly. Compliance management platforms have gained significant traction in the market. For startups and smaller businesses, these certifications are often crucial for breaking into markets where enterprise clients expect certain compliance standards as baseline requirements.

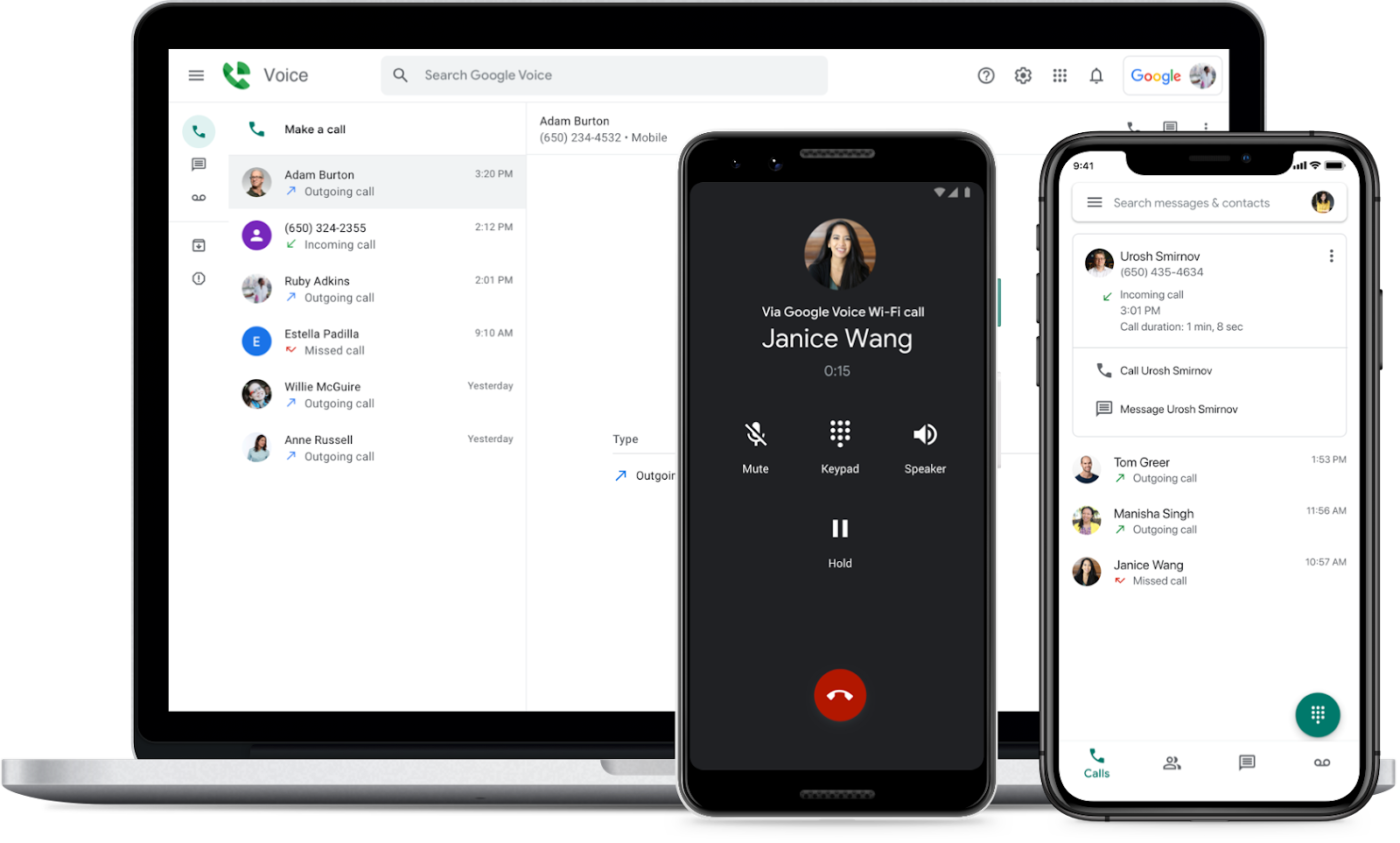

Vanta offers robust integrations that streamline evidence collection and enable continuous monitoring.

There’s no denying that platforms like Vanta have simplified compliance, but let’s BE REAL. They have apparent limitations. Compliance is a critical milestone, but it’s only one piece of the puzzle when it comes to comprehensive organizational security. Compliance-focused platforms fall short of meeting the baseline of a full cybersecurity strategy, no matter how streamlined and integrated they are.

The Risky Question: What Is Compliance Without a Security Focus?

In an era of relentless cyber threats, compliance alone simply isn’t enough. Certification may confirm that a company meets certain baseline standards, but it doesn’t guarantee resilience against sophisticated cyberattacks. So, what does compliance without a true security focus really achieve?

This distinction matters because compliance-focused platforms, like those initially built for SOC 2 or similar certifications, tend to emphasize getting certified quickly and efficiently. For many organizations, this approach is a selling point: with one specific certification, they can meet client requirements and secure new business. But if the end goal is simply to “get in the door,” these platforms can miss the mark on deeper security needs.

Here’s a quick litmus test to gauge a platform’s focus. Take a look at the number of frameworks and standards it supports. Platforms developed primarily for basic certifications, like SOC 2, typically emphasize a straightforward path to compliance.

On the other hand, a platform built with resilience in mind will offer a robust array of frameworks, showing it’s equipped to tackle both compliance and real-world security challenges. Centraleyes, for instance, offers a substantial library of over 70 frameworks! This isn’t just a talking point; it’s the groundwork for a deeply integrated approach that balances regulatory needs with active cyber risk management.

In high-stakes sectors like finance, healthcare, and critical infrastructure, where both compliance and security are vital, a comprehensive approach matters. Instead of merely “checking the box,” a platform like this helps companies stay adaptable—continuously ready to meet both emerging threats and new regulatory requirements. It’s a blend of compliance and resilience that supports genuine security, all while keeping an eye on the bigger picture.

The Shift Toward Cyber-Focused GRC Platforms

This brings us to the emerging niche of cyber-focused GRC platforms. Unlike compliance-first solutions, these platforms are designed with cybersecurity risk management at their core. They don’t oversimplify the process of getting companies compliant; they aim to make them resilient. With capabilities like advanced vulnerability management, continuous risk assessment, and incident response, these platforms provide a comprehensive approach that helps organizations go beyond compliance and build a strong security posture.

For companies that need both compliance and robust security, cyber-focused GRC tools represent a unique value proposition as Vanta alternatives. They support industry-standard certifications and empower organizations with the tools and insights to maintain real, actionable security.

Making the Right Choice: Strategic Evaluation of GRC Needs

Ultimately, choosing a GRC platform is about understanding what an organization truly needs to achieve. For some, the primary goal may be a streamlined path to certification, which Vanta and similar platforms are well-equipped to deliver.

For businesses that view compliance as just the starting point, a cyber-focused GRC platform may be a better fit. By bridging compliance with deeper cybersecurity, these tools offer a long-term approach that not only meets standards but also reinforces an organization’s resilience. For industries where risk management is paramount, a security compliance platform can be a powerful sales enabler, giving clients and stakeholders confidence in a company’s commitment to comprehensive protection.

Start Getting Value With

Centraleyes for Free

See for yourself how the Centraleyes platform exceeds anything an old GRC

system does and eliminates the need for manual processes and spreadsheets

to give you immediate value and run a full risk assessment in less than 30 days

Next Steps: Finding the Right Platform for Your Needs

For those assessing their options, the next step is to consider which platform aligns best with their strategic goals. In the following section, we’ll explore several alternatives to Vanta that strike a balance between compliance and robust cybersecurity.

GRC and Compliance Platforms You Should Know About

Here’s a look at seven top contenders, with Centraleyes leading the charge as a unique, cyber-focused GRC solution.

- Centraleyes: A Cybersecurity-Focused GRC Leader

Centraleyes is an advanced governance, risk, and compliance (GRC) platform designed to help organizations navigate the complexities of cybersecurity and compliance with ease. With an extensive library of over 70 frameworks, Centraleyes provides the flexibility and depth businesses need to meet diverse regulatory requirements—all in one place.

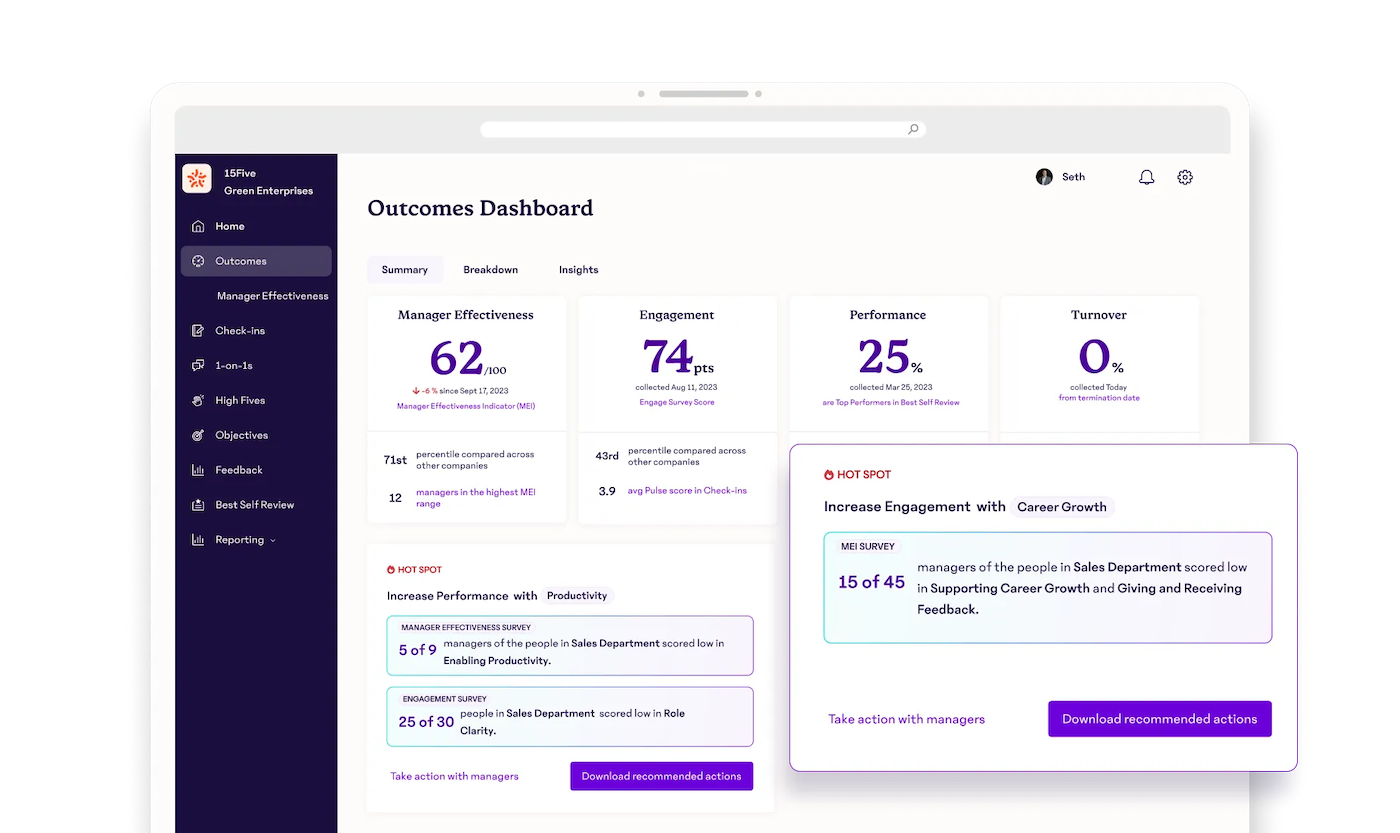

But it’s not just about compliance. Centraleyes seamlessly integrates compliance management with proactive cyber risk management. Thanks to its AI-driven risk register and advanced mapping capabilities, businesses can effortlessly align their security controls with the specific requirements of multiple frameworks at once. This means less manual work, fewer gaps, and a streamlined approach to risk and compliance that scales with your business.

Real-time insights, continuous risk assessments, and a user-friendly dashboard ensure make users in the know about their security posture. Whether you’re looking to meet regulatory deadlines, pass audits, or simply strengthen your overall security posture, Centraleyes makes it easier, smarter, and more efficient.

Key Features

- Extensive Framework Library (Over 70 Frameworks)

- AI-Driven Risk Register

- Advanced Cross-Framework Mappings

- Real-Time Risk & Compliance Insights

- Streamlined Collaboration

- Customizable Reporting and Dashboards

- Scalable to Any Organization Size

- Automated Workflow & Task Management

- Seamless Integration with Existing Systems

- Proactive Threat Detection & Risk Mitigation

- Lacework

Lacework is known for its focus on cloud security, which is particularly useful for companies with complex cloud environments. It’s built to provide deep visibility into cloud workloads and containers, making it a popular choice for organizations that operate in heavily virtualized or containerized environments. Lacework automates the collection and analysis of cloud data to identify risks and anomalies, which is particularly valuable for businesses prioritizing threat detection over traditional compliance.

Lacework’s strengths lie in its ability to integrate compliance within a broader, cloud-native security strategy, providing continuous monitoring for potential vulnerabilities in cloud applications. However, it’s not a full-scale GRC platform and may not cover all compliance frameworks.

- OneTrust

OneTrust is a popular platform for privacy, ethics, and compliance. Originally focused on privacy standards like GDPR and CCPA, OneTrust has grown into a comprehensive compliance solution covering vendor risk, ESG, and ethics management.

OneTrust shines in industries with strict privacy regulations, where data protection is a top priority. While it has strong compliance capabilities and covers a wide range of regulatory frameworks, OneTrust is not as security-centered as Centraleyes or Lacework. It’s ideal for businesses with heavy data privacy and regulatory compliance demands but may require supplemental tools to address deeper cybersecurity requirements.

- UpGuard

UpGuard specializes in third-party risk management and cybersecurity monitoring, with a particular focus on vendor security. For companies with extensive supplier or vendor networks, UpGuard provides critical insights into third-party risk, helping identify vulnerabilities before they become liabilities.

The platform allows organizations to continuously monitor their vendors’ security postures and proactively mitigate supply chain risks. UpGuard’s specialization in vendor risk makes it an excellent choice for organizations looking to build resilient supplier relationships. However, its GRC capabilities are more limited than platforms like Centraleyes, making it best suited for businesses focused specifically on third-party risk.

- LogicGate

LogicGate takes a unique approach to GRC by emphasizing workflow automation and customizability. Designed to provide flexible solutions for risk and compliance management, LogicGate allows organizations to tailor workflows to fit their unique requirements.

This flexibility is a double-edged sword; while highly customizable, LogicGate may require additional configuration to cover specific cybersecurity requirements fully. It’s an attractive option for companies with diverse, complex processes and a need for a tailored compliance and risk management approach. However, it may lack the cybersecurity focus and advanced monitoring capabilities that platforms like Centraleyes bring to the table.

- Secureframe

Secureframe has made a name for itself as a compliance automation platform designed for startups and smaller businesses aiming to achieve certifications like SOC 2 and ISO 27001. It streamlines the compliance process by automating evidence collection and providing audit templates, making it easy for teams to achieve compliance milestones quickly.

While Secureframe is a great choice for companies that need compliance certifications fast, it’s limited in terms of cyber risk management features. It’s ideal for businesses that need a quick compliance solution without a deep focus on security and risk management, which is why larger or security-focused companies might look to other platforms for more comprehensive GRC and cybersecurity needs.

- Vendorpedia

A specialized branch of the OneTrust family, Vendorpedia is dedicated exclusively to vendor risk management. The platform provides tools for evaluating and monitoring third-party vendors, helping companies maintain a high standard of security across their supply chains. Vendorpedia’s library of vendor profiles and its automated assessments streamline the vendor onboarding process, making it an efficient choice for companies with extensive third-party relationships.

While it provides critical vendor risk management tools, Vendorpedia’s GRC functionality is limited, making it more of a supplementary tool than a standalone GRC solution. For organizations that need comprehensive risk management, a platform with integrated cybersecurity features might be a better fit.

Cost Considerations

The Vanta pricing structure aligns with its focus on compliance. Businesses with more comprehensive security needs may find better value in Vanta competitors offering integrated risk management, which may require a larger initial investment but provide a longer-term security advantage.

Vanta costs start at approximately $7,500 annually for enterprises and can increase depending on several factors.

- Number of Employees

- Selected Frameworks

- Existing Security Posture

- Contract Term

- Add-On Features

Selecting the Right Platform for Your Needs

No GRC platform is one-size-fits-all, and each offers unique strengths depending on organizational requirements. By carefully evaluating these options, companies can find a solution that meets their compliance goals and aligns with their overall risk and cybersecurity strategy.

Start Getting Value With

Centraleyes for Free

See for yourself how the Centraleyes platform exceeds anything an old GRC

system does and eliminates the need for manual processes and spreadsheets

to give you immediate value and run a full risk assessment in less than 30 days

The post Top 7 Vanta Alternatives to Consider in 2025 appeared first on Centraleyes.