What is Open Enrollment? Tips & Strategies for Employers (2025)

Key takeaways

Open enrollment is an annual period where employees can elect or change their benefits. Prepare for open enrollment by setting up your benefits tools and communication strategies before the allotted period begins. Offering the right benefits during open enrollment can positively impact employee satisfaction and retention.

- Nov. 22, 2024: Kaylyn McKenna updated the article to provide up-to-date information about open enrollment deadlines, eligibility, and other compliance requirements. She also added tactical steps you can follow for a successful open enrollment period. Jessica Dennis wrote the original version of this article, which was published on January 30, 2023 and previously updated on January 2, 2024.

I am an experienced HR writer who has researched benefits options and tested benefits software for several years. While working in HR previously, I supported the open enrollment process for multiple small businesses.

Featured partners

What is open enrollment for benefits

Open enrollment is an annual period when your employees can elect or make changes to their benefit plans, such as health, dental, vision, pet, or life insurance. Employees may also enroll or change retirement, short-term disability, or long-term disability benefits.

This applies to benefits offered through your company or on the insurance marketplace through the Affordable Care Act (ACA). Further, the ACA requires covered employers to offer health insurance to employees working full-time (defined as 30 or more hours per week). It also sets up a public marketplace where people can shop for coverage and receive subsidies based on their income level.

Outside of open enrollment, employees are generally only allowed to modify their core benefits, such as health insurance, when they experience a qualifying event. Qualifying events include getting married, having a child, or starting a new job.

Who is eligible for open enrollment?

You’ll want to cover any employee who is eligible for benefits in your open enrollment process, including those who are currently enrolled in benefits such as health insurance through your company. The exact eligibility guidelines will depend on your company policies and applicable laws. For example, employees may need to work a certain number of hours per week or be employed for a specific amount of time before becoming eligible for benefits.

Applicable large employers (ALEs) need to follow the ACA, which requires offering affordable health plans to employees who work an average of 30 hours a week after one year. Employers must also provide health coverage to eligible employees under state laws. Otherwise, your company determines eligibility criteria (such as waiting periods or employee roles). Whatever you decide needs to be applied equally to all employees in the same situation.

Open enrollment dates and deadlines for 2025

Employer open enrollment deadlines can vary. Check with your healthcare brokers or providers to see if they have any specific deadlines for annual open enrollment. While most employers conduct open enrollment towards the end of the year, some also follow their fiscal year and conduct open enrollment mid-year. This may be beneficial for budgeting purposes, such as working new benefits offerings into your annual budget.

However, it is generally better for employees if you schedule open enrollment during the traditional end-of-year period so that they can evaluate all of their options, such as their spouses’ employer-sponsored insurance or marketplace plans.

You’ll typically want to schedule your open enrollment around the same time period as your state’s ACA marketplace open enrollment window so employees can evaluate all of their options for coverage. The ACA enrollment window also often coincides with health insurance providers’ open enrollment periods since many insurance companies provide coverage through the public marketplace and employer-sponsored coverage. Review the key dates below for each enrollment type and state.

- Medicare coverage enrollment: November 1 to January 15 (for most states).

- Medicare Advantage plan enrollment: January 1 to March 31.

- ACA marketplace: November 1 to January 15 (for most states).

The ACA marketplace and Medicare open enrollment period takes place from November 1 to January 15, as listed above. For some states, below are the special open enrollment period dates.

| State | ACA open enrollment dates |

|---|---|

| California | Nov. 1 to Jan. 31 |

| Idaho | Oct. 15 to Dec. 15 |

| Maryland | Nov. 1 to Dec. 15 |

| Massachusetts | Nov. 1 to Jan. 23 |

| New Jersey | Nov. 1 to Jan. 31 |

| New York | Nov. 16 to Jan. 31 |

| Rhode Island | Nov. 1 to Jan. 31 |

| Washington, D.C. | Nov. 1 to Jan. 31 |

Employees will also need to pay attention to deadlines for coverage to begin on January 1st. In most states, you’ll need to enroll by December 15 for coverage to begin on January 1. Later registrations will result in coverage starting on February 1.

Preparing for a successful open enrollment

Here are some key things to do to set yourself up for success during your open enrollment period.

Plan ahead

Try to prepare as far as possible for open enrollment, particularly if you’re planning to add benefits offerings or change brokers. Larger companies often start planning three to six months out to allow plenty of time to assess their options and set up contracts with benefits providers.

Review legal changes

Before open enrollment, check in and see if there are any legal changes or compliance issues that may impact your open enrollment period. If you’re running a smaller, growing business, this is a good time to tally your employee headcount, as that may impact the resources and requirements that will apply to you in terms of ACA compliance.

You’ll also want to consider any new regions where you’re employing people. Offering global benefits in new territories or even in new states can come with fresh legal considerations.

Understand employees’ priorities

Every employee group is different, so it’s important to tailor your benefits package and healthcare coverage options to your employees’ unique needs and priorities. You’ll want to survey employees and collect feedback on their priorities and which fringe benefits will be most impactful to them. For example:

- New families may appreciate learning about benefit plans with extensive pediatric coverage or Flexible Spending Accounts (FSAs) that cover childcare expenses.

- Workers nearing retirement may care most about retirement savings plans and financial wellness benefits that can support them in planning ahead.

- Those in cities may appreciate commuter benefits to help them cover transit expenses or higher parking costs.

You can use employee survey tools like SurveySparrow or Zoho Survey to easily collect this data digitally and then analyze it to decide what benefits to offer. Keep in mind that priorities will vary, and it’s alright to choose a few voluntary benefits tailored to different portions of your employee base. If someone doesn’t need fringe benefits like a dependent care FSA, they can decline the benefit. These voluntary benefits can still strengthen your benefits package and improve employee satisfaction and retention while often costing less due to lower participation.

Explore coverage options

Before employees make their selections for benefits during the enrollment period, you’ll need to select what health insurance plan types and other benefits you want to offer.

One of the best things that you can do to improve your employee benefits package and open enrollment process is to offer a wider range of plan options for health insurance coverage. There are a variety of plan types to choose from, including different tiers within each category. Health insurance coverage options include:

HDHP plans have high deductibles but lower monthly premiums. Employees will pay the lowest monthly cost for their healthcare coverage but will have a higher deductible. This means that they will need to pay more out of pocket when they seek health care until they meet a certain threshold.

HMOs require enrollees to see providers within a defined health network and go through a primary care provider for referrals to specialists. These plans tend to have lower premiums.

A PPO plan offers employees more freedom in choosing medical providers. They can see any provider they want but will get the best rates at preferred providers. This tends to be the most costly plan type in terms of premiums.

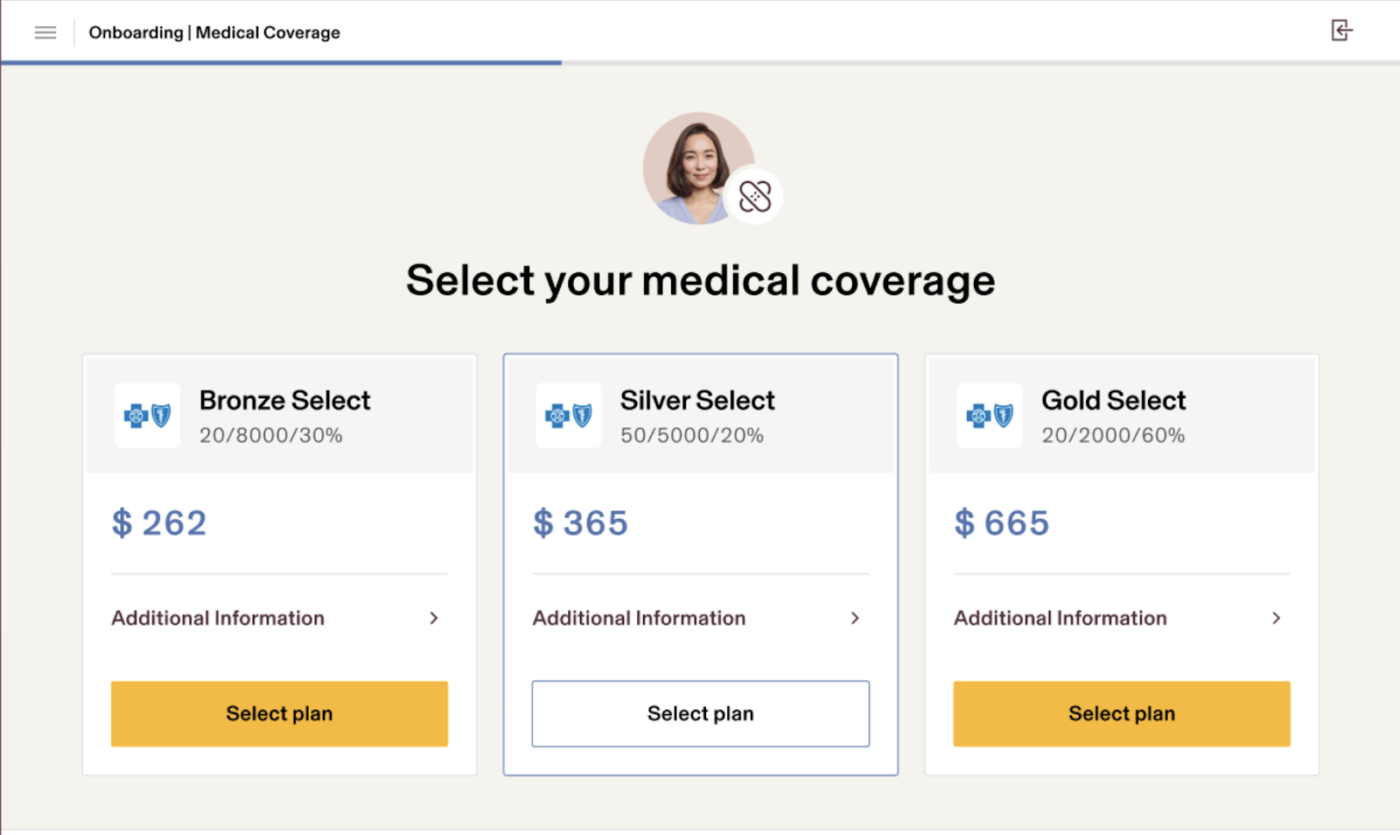

Within these plan types, there are also different tiers: bronze, silver, gold, and platinum. The higher tiers, such as platinum and gold, offer more comprehensive coverage with lower copays and little to no deductibles, but the premium that employees (and you as the employer) pay will be higher.

Open enrollment tips

An effective open enrollment process can mitigate the confusion surrounding benefit choices for your employees and increase engagement. By following the tips below, employers can get a jumpstart on their open enrollment policies and procedures.

Communicate benefits options effectively

It’s important to properly educate your employees on key benefits changes and open enrollment deadlines. Even employees already enrolled in benefits should still be made aware of any new offerings and have the opportunity to change their selections for the upcoming plan year.

Employers should use communication methods that best target their workforce. Communication strategies include:

- Virtual benefit fairs or webinars: Reach remote employees with online benefits overviews from your team or the vendors.

- One-on-one sessions with HR: Give workers with complex life concerns the opportunity to discuss benefit options that cover their particular circumstances with individual sessions.

- Information packets: Give employees written overviews, comparisons, and benefit explanations to help those who learn best through reading or need materials to take home to look at with their spouse.

It’s important to communicate clearly and offer plenty of opportunities for employees to get more hands-on assistance. Also, give employees a heads-up on whether they’ll be automatically re-enrolled in their current plan if they don’t make a new selection. Many employers and HR software programs will automatically carry over the employee’s prior plan selections if they don’t submit any changes.

Streamline the process with benefits administration software

Your benefits administration software and other decision support tools can make the open enrollment process easier for you and your employees. Benefits administration software reduces the time needed for employers to manually enroll employees in benefit programs by allowing employees access to online self-service portals. Further, benefits software can better guide your employees through their benefits selections and paperless enrollment. Platforms like Rippling also make it easier for employees to review their options and compare costs and coverage.

Lastly, benefits software also makes it easier to track employee participation and send out notifications to those who have not made enrollment selections yet. This reduces the headache of manually tracking who has turned in their enrollment forms or dealing with employees coming to you after the deadline saying that they forgot to submit their selections.

Also read: 7 Questions to Consider Before Choosing a Benefits Administration System

Open enrollment FAQs

The exact length of open enrollment will vary by employer or state, but it’s generally one to two months for marketplace options. Private employers, however, may have shorter enrollment periods that last as little as one to two weeks. Aim to give your employees enough time to review their options and make an informed choice.

Your open enrollment process can include any benefits that employees need to enroll in or opt in to. These may include health insurance, vision and dental insurance, life and disability insurance, flexible spending accounts, health savings accounts, 401(K)s, and more. Open enrollment does not need to include any benefits that all employees are automatically enrolled in, such as paid time off.

Yes, employees can enroll in benefits outside of open enrollment if they experience a qualifying event or during their initial enrollment period when they first become eligible for benefits (such as following a waiting period after hire).

Qualifying events include losing their current health coverage (such as losing coverage through your spouse or parent’s insurance), moving to a different zip code or county, getting married, welcoming a child, or other key household changes. If the employee experiences a qualifying event, they can make changes to or enroll in benefits outside of open enrollment.

The post What is Open Enrollment? Tips & Strategies for Employers (2025) appeared first on TechnologyAdvice.